Cooking Ingredients Market Size to Worth USD 126.56 Billion by 2034 | Towards FnB

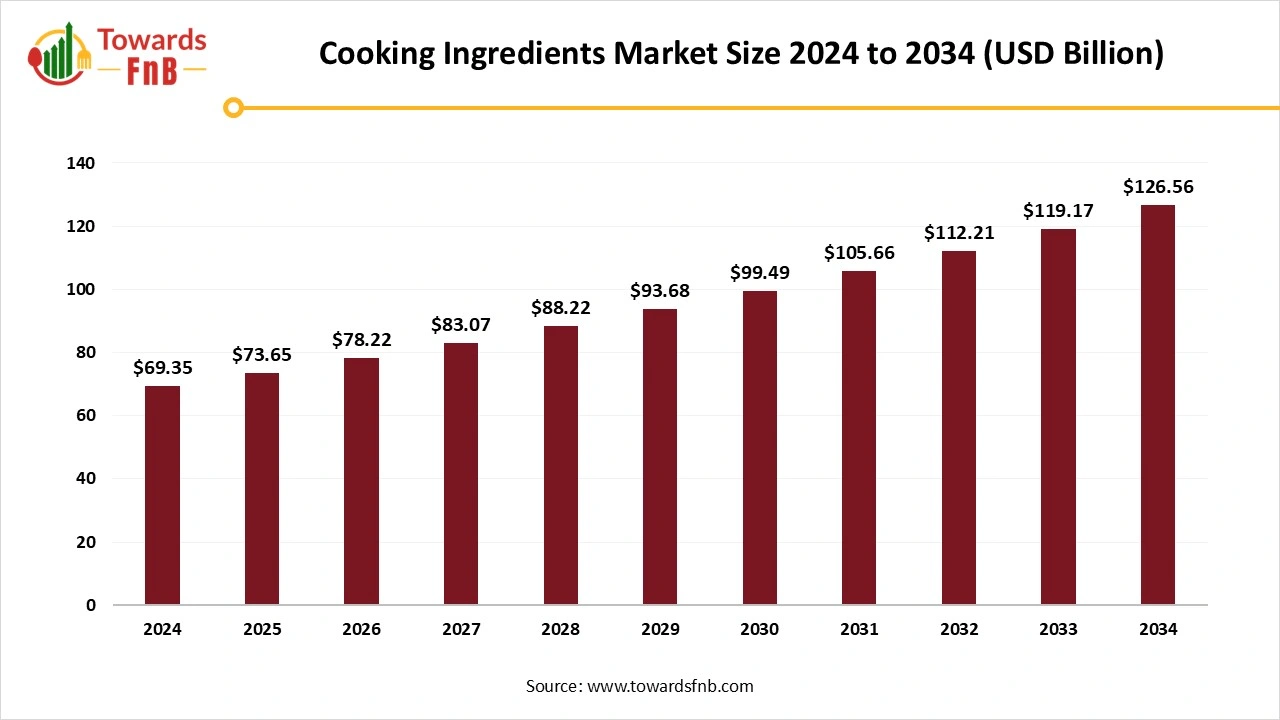

According to Towards FnB, the global cooking ingredients market size is calculated at USD 73.65 billion in 2025 and is projected to exceed over USD 126.56 billion by 2034, expanding at a CAGR of 6.2% during the forecast period from 2025 to 2034. The growth is driven by increasing consumer demand for clean-label products, plant-based alternatives, and premium culinary ingredients across both household and industrial applications.

Ottawa, Sept. 18, 2025 (GLOBE NEWSWIRE) -- The global cooking ingredients market size stood at USD 69.35 billion in 2024 and is anticipated to increase from USD 73.65 billion in 2025 to around USD 126.56 billion by 2034, at a CAGR of 6.2% from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research.

The market has been growing in recent years due to the rise of a health-conscious population, cooking enthusiasts, and individuals seeking to try new dishes and explore different cuisines.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5705

Key Highlights of Cooking Ingredients Market

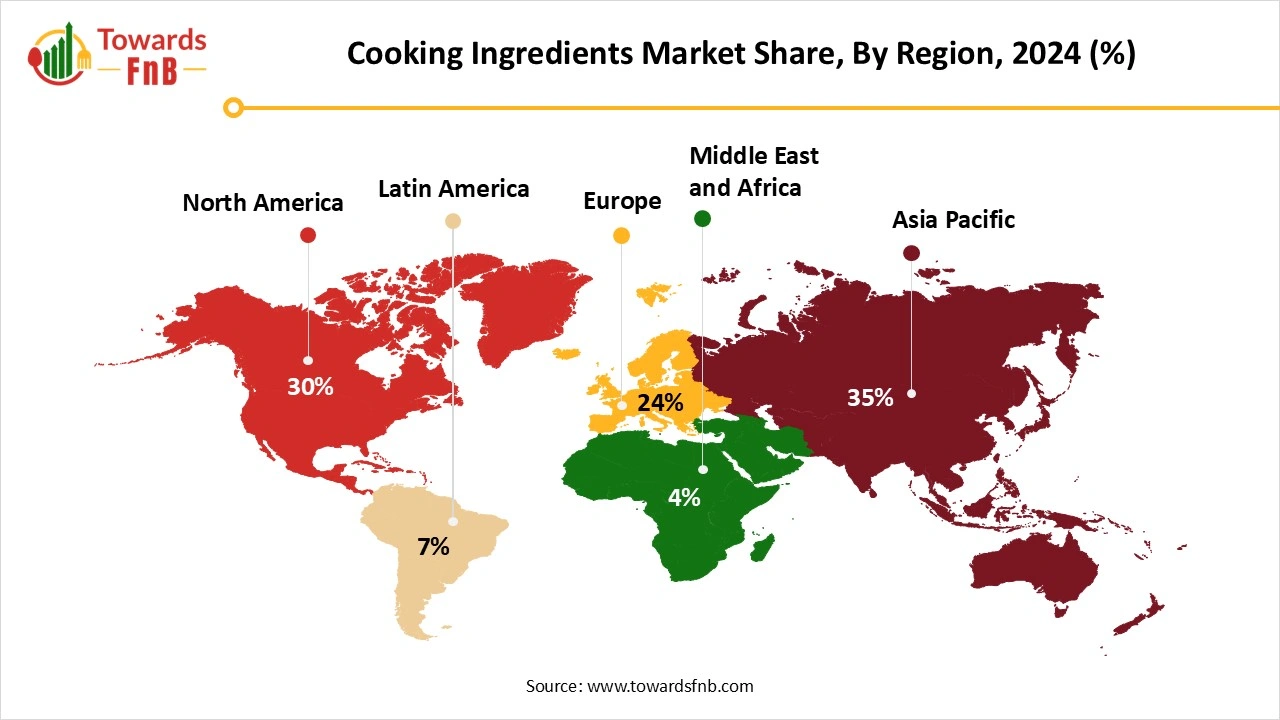

- By region, the Asia Pacific dominated the cooking ingredients market with highest share of 35% in 2024, whereas the Middle East and Africa are expected to grow in the forecast period.

- By type, the edible oil segment led the cooking ingredients market with share of 28% in 2024, whereas the plant-based sweeteners segment is expected to grow in the foreseeable period.

- By source, the plant-based segment captured the maximum share of 60% in 2024, whereas the fermented/bio-based segment is expected to grow in the foreseeable period.

- By form, the liquid segment led the cooking ingredients market, whereas the paste/gel segment is observed to grow with the highest CAGR in the foreseen period.

- By application, the household segment dominated the market with largest share of 50% in 2024, whereas the industrial food processing segment is expected to grow in the foreseeable period.

- By distribution channel, the offline retail segment dominated the market in 2024 by holding share of 55%, whereas the online retail segment is expected to grow in the forecast period.

-

By function, the flavoring agents segment contributed the largest market share of 40% in 2024, whereas the nutritional enhancer segment is expected to grow in the expected timeframe.

How do Cooking Ingredients Contribute to Enhancing Culinary Experiences?

The cooking ingredients market refers to the use of cooking ingredients for the preparation of meals at the household and industrial levels to enhance the flavor, nutritional content, appearance, and aroma of food items. The ingredients also help to enhance the culinary experience, further fueling the growth of the market. The market consists of different types of cooking ingredients such as sauces, spices, herbs, condiments, sweeteners, and various other ingredients, further enhancing the growth of the cooking ingredients market. The changing consumer preferences due to high demand for nutritional food products, health and wellness, and the growth of health-conscious consumers are further fueling the market’s growth.

Impact of Artificial Intelligence on the Cooking Ingredients Market

Artificial intelligence (AI) is transforming the cooking ingredients market by driving innovation, improving efficiency, and aligning products with evolving consumer demands. In product development, AI-powered algorithms analyze massive datasets on health trends, dietary preferences, and regional cuisines to help manufacturers design new cooking ingredients, such as low-sodium seasonings, plant-based alternatives, and fortified blends, that meet the growing demand for healthier and more functional foods. Machine learning also predicts optimal ingredient combinations to replicate traditional flavors while catering to clean-label and allergen-free requirements.

In manufacturing, AI-driven predictive analytics optimize processes like mixing, refining, and packaging, improving consistency, reducing waste, and lowering production costs. Computer vision systems enhance quality control by detecting impurities, adulteration, or labeling errors in real time, ensuring safety and compliance. On the consumer side, AI recommendation engines used by e-commerce platforms and grocery retailers personalize product suggestions based on individual dietary needs, shopping behavior, and recipe preferences. Sentiment analysis of online reviews and social media further provides insights into shifting consumer interests, such as demand for organic, sustainable, or globally inspired ingredients.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/cooking-ingredients-market

Recent Developments in the Cooking Ingredients Market

- In May 2025, Compound Foods launched their beanless coffee, ‘Minus Coffee’, made from roasted upcycled roots, date seeds, chicory, sunflower seeds, carob, and grape seeds. Cocoa supply chain issues are one of the major reasons for the launch of the beanless coffee. (Source- https://www.foodbusinessnews.net)

- In March 2025, Louis Dreyfus Company (LDC), a leading global merchant and processor of agricultural goods, introduced its new plant-based Vitamin E products and an expanded food ingredients product line at the 2025 Food Ingredients China exhibition. The company is set to provide plant-based vitamin E solutions such as mixed tocopherols, acetate products, succinate products, and more. (Source- https://www.ldc.com)

New Trends in the Cooking Ingredients Market

- Rising awareness for health and wellness, further leading to high demand for functional and fortified food ingredients, is helping the growth of the cooking ingredients market.

- High demand for healthy food components and ingredients involving no-sugar, no-gluten, and lactose-free content is helping the growth of the market. Such food products are highly demanded by health-conscious consumers.

- Growing consumer following a vegan or vegetarian diet, leading to high demand for functional and fortified foods, is also aiding the growth of the market.

Product Survey of the Cooking Ingredients Market

| Ingredient Type | Key Attributes / Features | Demand Drivers | Example Uses |

| Edible Oils & Cooking Fats | Oils from plants (olive, sunflower, canola, palm etc.), fats (butter, ghee, shortening); differ by smoke point, flavor, saturation level | Health concerns (lower saturated fats), clean-label, preference for natural or premium oils, rise of home cooking and frying/grilling | Sautéing, frying, baking, salad dressings, marinades |

| Spices, Herbs & Seasonings | Dried or fresh herbs, spice blends, single spices; richness of flavor, aroma, heat, color, profile diversity | Desire for bold flavors, ethnic / global cuisines, food personalization, rising interest in homemade meals | Curries, rubs, sauces, soups, finishing seasoning |

| Sauces, Condiments & Pastes | Prepared sauces (tomato sauce, hot sauce), pastes (garlic, chili, curry paste), condiments (mustard, soy sauce) that add depth, moisture, umami etc. | Convenience, flavor boost, time saving in cooking, international cuisine trends, shelf stability | Stir fries, marinades, dips, ready meals, sandwiches |

| Sweeteners (Natural & Alternative) | Sugar, honey, maple syrup, plant-based sweeteners (stevia, monk fruit etc.), syrups; varying sweetness intensity and functional behavior | Health consciousness, reducing sugar, demand for “natural,” clean-label, dietary restrictions (e.g. diabetics) | Baking, beverages, glazes, sauces |

| Flour & Starches / Thickening Agents | Wheat flour, rice flour, tapioca, cornstarch, potato starch; used for structure, thickening, binding, texture | Gluten-free trends, texture preferences, clean label, replacing refined carbs with more wholesome alternatives | Roux, gravies, sauces, batters, breading, thick soups |

| Salt, Acids & Flavor Enhancers | Table salt, sea salt, flavored salts; acids like vinegar, lemon juice; enhancers like MSG or umami-rich compounds | Flavor optimization, preservation, balancing taste, masking off-notes, trend toward “umami” flavor profiles | Pickling, preservation, finishing touches, balancing sweetness or fat |

| Nutritional Enhancers & Functional Ingredients | Vitamins, minerals, plant proteins, fibers, probiotics, antioxidants; incorporated into everyday cooking | Rising health awareness, functional food demand, fortification, dietary restrictions, aging populations | Fortified sauces, protein-rich cooking, high fiber baking, immune-boosting soups |

| Natural Colors & Extracts | Plant extracts (turmeric, beetroot, paprika etc.), natural dyes, floral/herbal extracts | Clean label, consumer demand for visually appealing food without synthetic additives | Spice blends, sauces, baked goods, beverages, ornamental food plating |

| Fermented / Umami / Specialty Flavor Compounds | Soy sauce, miso, fish sauce, fermented pastes; umami boosters; depth of flavor, complexity | Ethnic cuisine interest, desire for depth & complexity, alternative to meat flavors, rising plant-based cooking | Marinades, stews, vegetarian/vegan dishes, flavor base for sauces |

Market Dynamics

What are the growth drivers of the Cooking Ingredients Market?

Rising health and wellness trends, demand for fortified and functional foods, protein-rich beverages and snacks, and prevalence of lifestyle-related disorders are some of the major factors for the growth of the market. Cooking ingredients help to enhance the taste, aroma, appearance, and nutritional content of food items and cuisines, helping the growth of the cooking ingredients market. Rising disposable income and a conscious attitude are also some of the major market growth factors.

Challenge

High Cost of Raw Materials and Strict Rules are obstructing the Growth of the Market.

High costs of raw materials for the manufacturing of different types of cooking ingredients to enhance the flavor, taste, aroma, and appearance of different cuisines may restrain the growth of the market. Strict rules followed by the regulatory bodies for the manufacturing of flavoring agents, preservatives, allergens, and additives are another restraint observed in the growth of the market. Fluctuations in the prices of raw materials, supply chain interruptions, climatic changes, and various other factors also obstruct the growth of the market.

Opportunity

Demand for Personalized and Customized Cooking Ingredients is helpful for the Growth of the Market.

The high demand for personalized cuisines and food options requiring different types of cooking ingredients is a major opportunity for the growth of the cooking ingredients market. Personalized products as per certain health issues and concerns by consumers is also a major factor for the growth of the market. Such instances may involve the use of ingredients for healthy digestion, improved immunity, and overall health.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5705

Cooking Ingredients Market Regional Analysis

Asia Pacific dominated the Cooking Ingredients Market in 2024

The growing population of the region, further leading to high demand for the food and beverage industry, is one of the major factors for the growth of the cooking ingredients market in the region. Rising disposable income and hectic schedules of consumers are further leading to high demand for convenient food options, also helping the growth of the market. High demand for functional, fortified, and clean-label products due to their high nutritional content is also a major factor for the growth of the market in the region in 2024.

The Middle East and Africa are expected to grow in the Foreseen Period.

The Middle East and Africa are expected to grow in the foreseen period due to high demand for different types of cooking ingredients, rising urbanization, growing population, and high demand for convenient and fast food options. High demand for functional, organic, healthy, and clean-label food options is also helping the growth of the cooking ingredients market. High demand for low-calorie, sugar-free, and less additive and preservative food options is also high in demand, leading to further market growth.

Cooking Ingredients Market Report Scope and Coverage

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 6.2% |

| Market Size in 2024 | USD 69.35 Billion |

| Market Size in 2025 | USD 73.65 Billion |

| Market Size by 2034 | USD 126.56 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Cooking Ingredients Market Segmental Analysis

Type Analysis

The edible oils segment led the cooking ingredients market in 2024 due to rising consumer awareness about health consciousness and high demand for plant-based cooking oils such as sunflower, peanuts, and olive oil. Consumers today are also picky about choosing edible oils due to the rising prevalence of health issues such as obesity, diabetes, and heart problems. Hence, healthier edible oil are highly demanded by consumers, fueling the growth of the market. The market further observes growth due to helpful marketing strategies, new edible oil flavor options, and many other similar factors.

The plant-based sweeteners segment is expected to grow in the foreseeable period due to rising consumer awareness regarding the prevalence of multiple health issues. Health-conscious consumers are highly demanding for low-calorie or no-sugar food items to maintain a healthy system and strong immunity. Such products also help to maintain the sugar and cholesterol levels of consumers to avoid multiple related health issues, further fueling the growth of the cooking ingredients market in the foreseeable period.

Source Analysis

The plant-based segment dominated the cooking ingredients market in 2024 due to the rising number of health-conscious consumers relying on the benefits of a plant-based diet. The rising number of vegans and vegetarians is also a major reason for the growth of the market. Easy availability of plant-based meat substitutes is also aiding the growth of the cooking ingredients market in the coming years. A plant-based diet is healthy for the body and is beneficial for heart health, easy weight management, controlled cholesterol and sugar levels, and hence is opted for by consumers, further fueling the growth of the market.

The fermented/bio-based ingredients segment is observed to grow at a notable rate in the foreseen period due to the increasing importance of fermented food products. Such food options are ideal for gut health and also help to boost immunity, further fueling the growth of the market. High demand for organic and clean-label food options also helps the growth of the cooking ingredients market in the foreseeable period. Fermentation technology helps to enhance the nutritional content of food products and also helps the growth of the market.

Form Analysis

The liquid segment led the cooking ingredients market in 2024 due to its ease of use in different types of cuisines and dishes, while cooking meals further aided the growth of the market. The segment is also observed to grow due to its ease of storage, and it can also he handled and carried easily in storage bottles and containers. Hence, the segment helped the market flourish in 2024.

The paste/gel segment is expected to grow in the foreseen period due to its high demand in the bakery and confectionery segment, along with various other domains, which are helpful for the growth of the cooking ingredients market. The paste/gel consistency is easy to use and easy to handle, and is used in multiple dishes to enhance their flavors. Such consistencies can be used for the preparation of drinks as well as multiple food options, further fueling the growth of the market in the foreseeable period.

Application Analysis

The household segment dominated the cooking ingredients market in 2024 due to high usage of cooking ingredients in households for the preparation of different types of cuisines and dish preparations. Such ingredients help to enhance the texture, flavor, depth, and appearance of a dish, making it more appealing and helping the growth of the market. The ingredients also help to enhance the nutritional quality of food, further helping the growth of the market. The requirement of different types of cooking ingredients for the preparation of different culinary cuisines also helps the growth of the cooking ingredients market in 2024.

The industrial food processing segment is expected to grow in the expected timeframe due to the growing population of consumers inclined towards convenient and fast-food industries, which are helpful for the growth of the market. High demand for nutritious and easy-to-prepare meal options is also aiding the growth of the market in the foreseeable period. Growing urbanization, growing population, and high demand for nutrient-dense food options by convenient methods are also helping the growth of the market.

Distribution Channel Analysis

The offline retail segment led the cooking ingredients market in 2024 due to high demand for edible oils on platforms such as supermarkets, hypermarkets, departmental stores, and grocery shops. Such places allow consumers to shop for different types of products under one roof. Consumers can also buy different types of edible oils in different price ranges, further fueling the growth of the market. One can also find different types of edible oils in different flavor options, which is very helpful for the growth of the segment.

The online retail segment is expected to grow in the foreseeable period due to its convenience factor, allowing consumers to shop from an e-commerce platform to get different types of cooking ingredients at different prices. Availability of different types of recipes, blogs, and cooking channels online, and the urge to replicate those cuisines and learn new dishes is other major factor for the growth of the segment, further fueling the growth of the market. Such factors aid the growth of the cooking ingredients market in the foreseeable period.

Function Analysis

The flavoring agent segment dominated the cooking ingredients market in 2024 due to high demand for convenient food options, innovative product creation, and high preference for natural and nature-identical flavorings. Flavoring agents help to enhance the taste, scent, and appearance of food items prepared at the household or industrial level, further helping the growth of the market. China, being the largest exporter of flavoring agents globally, makes a major contribution to the growth of the cooking ingredients market in 2024.

The nutritional enhancer segment is expected to grow in the forecast period due to rising awareness of lifestyle-related issues such as diabetes, obesity, and high blood pressure levels. Hence, it further aids the demand for nutritious and healthy food options such as functional and fortified foods and drinks. The enhancers also help to enhance the taste, aroma, and nutritional value of food items, which is helpful for the growth of the market. They help to add nutritional components to food options such as vitamins, minerals, omega-3 fatty acids, and other essentials.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Specialty Food Ingredients Market: The global specialty food ingredients market size is projected to witness strong growth from USD 113.01 billion in 2025 to USD 179.87 billion by 2034, reflecting a CAGR of 5.3% over the forecast period from 2025 to 2034.

- Food for Special Medical Purpose Market: The global food for special medical purpose market size is positioned for rapid expansion, with projected revenue increases over the next decade, spurred by the widespread efforts by key players across the globe.

- Natural Food Colorants Market: The global natural food colorants market size is projected to grow from USD 2.06 billion in 2025 to USD 3.96 billion by 2034, reflecting a CAGR of 7.5% over the forecast period from 2025 to 2034.

- Hemp-Based Foods Market: The global hemp-based foods market size is projected to climb USD 7.83 billion by 2025 to USD 19.24 billion by 2034, expanding at a CAGR of 10.5% during the forecast period from 2025 to 2034.

- Organic Pet Food Market: The global organic pet food market size is projected to expand from USD 2.54 billion in 2025 to USD 4.41 billion by 2034, growing at a CAGR of 6.34% during the forecast period from 2025 to 2034.

- Canada Food Service Market: The Canada food service market size is course to grow from USD 135.63 billion in 2025 to USD 583.47 billion by 2034, growing at a CAGR of 17.6% during the forecast period from 2025 to 2034.

- Wet Pet Food Market: The global wet pet food market size is projected to witness strong growth from USD 27.90 billion in 2025 to USD 41.75 billion by 2034, reflecting a CAGR of 4.58% over the forecast period from 2025 to 2034.

- Food Service Market: The global food service market size is projected to witness strong growth from USD 3,758.58 billion in 2025 to USD 7,389.11 billion by 2034, reflecting a CAGR of 7.8% over the forecast period from 2025 to 2034.

-

Enriched Food Market: The global enriched food market size is expected to grow from USD 196.33 billion in 2025 to USD 460.30 billion by 2034, at a CAGR of 9.93% over the forecast period from 2025 to 2034.

Top Companies in the Cooking Ingredients Market

- Archer Daniels Midland Company (ADM) – Global agribusiness leader producing edible oils, flours, sweeteners, and specialty ingredients for cooking and food manufacturing.

- Cargill, Incorporated – Supplies edible oils, cocoa, starches, salts, and functional cooking ingredients across foodservice and retail markets.

- Associated British Foods plc – Diversified group with major holdings in sugar, flour, yeast, seasonings, and consumer food brands.

- Bunge Limited – Leading producer of edible oils, oilseeds, and milling products widely used in cooking and packaged foods.

- Wilmar International Limited – Asia’s largest agribusiness, strong in edible oils, specialty fats, and ingredients for household and industrial cooking.

- Olam International – Global supplier of spices, seasonings, cocoa, and other natural ingredients used in cooking and flavor systems.

- Kerry Group – Provides taste and nutrition solutions, including seasonings, sauces, and functional ingredients for cooking applications.

- McCormick & Company, Inc. – World leader in herbs, spices, and seasoning blends, central to home and foodservice cooking.

- Nestlé S.A. – Produces culinary products including bouillons, sauces, seasonings, and cooking aids under global brands.

- Unilever plc – Offers iconic cooking and culinary brands such as Knorr, Hellmann’s, and seasoning mixes worldwide.

- Ajinomoto Co., Inc. – Pioneer of umami seasonings (MSG) and producer of sauces, flavor enhancers, and amino-acid-based ingredients.

- Conagra Brands, Inc. – Supplies packaged cooking ingredients and ready-to-use sauces under brands like Hunt’s and Gardein.

- Tate & Lyle PLC – Specializes in sweeteners, starches, and texturizers widely used as cooking and food preparation ingredients.

- The Kraft Heinz Company – Offers condiments, sauces, and packaged cooking essentials like Heinz ketchup and Kraft dressings.

- General Mills, Inc. – Produces flours, baking mixes, and cooking ingredients through brands like Gold Medal and Betty Crocker.

- Ingredion Incorporated – Supplier of starches, sweeteners, and texturizing agents for cooking and processed food applications.

- Hain Celestial Group – Focused on natural and organic cooking ingredients, sauces, oils, and seasonings.

- Südzucker AG – Europe’s largest sugar producer and supplier of sweetening agents used in home and industrial cooking.

- BASF SE (for functional ingredients) – Provides fortification and functional additives such as vitamins and carotenoids for cooking applications.

- DSM-Firmenich – Offers nutritional and flavor solutions, including encapsulated vitamins, taste enhancers, and functional food ingredients.

Segments Covered in the Report

By Type

- Edible Oils

- Vegetable Oils (Soybean, Palm, Canola)

- Olive Oil

- Coconut Oil

- Sunflower Oil

- Avocado Oil

- Sweeteners

- Sugar (Cane, Beet)

- High-Fructose Corn Syrup (HFCS)

- Honey

- Jaggery

- Stevia

- Agave

- Artificial Sweeteners

- Flours & Grains

- Wheat Flour

- Rice Flour

- Cornmeal

- Multigrain

- Oat Flour

- Gluten-Free Flour

- Spices & Herbs

- Whole Spices (Cumin, Cardamom)

- Ground Spices (Turmeric, Paprika)

- Fresh Herbs

- Dried Herbs

- Condiments & Sauces

- Soy Sauce

- Tomato Ketchup

- Mustard

- Mayonnaise

- Hot Sauce

- Barbecue Sauce

- Vinegar

- Seasoning Blends

- Mixed Seasonings (e.g., Garam Masala, Italian seasoning),

- Bouillon Cubes

- Baking Ingredients

- Yeast

- Baking Soda

- Baking Powder

- Vanilla Extract

- Cocoa Powder

- Dairy-Based Ingredients

- Butter

- Ghee, Cream

- Cheese for cooking

- Others

- Cooking Wines

- Flavor Enhancers (MSG)

- Thickeners (Cornstarch, Arrowroot)

By Source

- Plant-based

- Animal-based

- Synthetic/Artificial

- Fermented/Bio-based

By Form

- Solid (Powder, Granules, Cubes)

- Liquid (Oils, Sauces, Vinegar)

- Paste/Gel (Tomato Paste, Garlic-Ginger Paste)

By Application

- Household

- Commercial Kitchens

- Foodservice (HORECA)

- Industrial Food Processing

By Distribution Channel

- Offline Retail: Supermarkets, Hypermarkets, Grocery Stores, Specialty Stores

- Online Retail: E-commerce platforms, D2C brands

- Foodservice Distributors

By Function

- Flavoring Agent

- Preservative

- Coloring Agent

- Texturizer/Thickener

- Leavening Agent

- Nutritional Enhancer

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5705

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies |

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Yogurt Market: https://www.towardsfnb.com/insights/yogurt-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Food Additives Market: https://www.towardsfnb.com/insights/food-additives-market

➡️Baking Ingredients Market: https://www.towardsfnb.com/insights/baking-ingredients-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Dairy Processing Equipment Market: https://www.towardsfnb.com/insights/dairy-processing-equipment-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Organic Food Market: https://www.towardsfnb.com/insights/organic-food-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dietary Supplements Market: https://www.towardsfnb.com/insights/dietary-supplements-market

➡️Plant-Based Protein Market: https://www.towardsfnb.com/insights/plant-based-protein-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Frozen Food Market: https://www.towardsfnb.com/insights/frozen-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.