Sweetness Modulators Market Set to Reach USD 4.21 Billion by 2036 as Sugar Reduction Drives Global Reformulation Efforts

Sweetness modulators market is expanding steadily as food and beverage companies intensify sugar reduction reformulation while preserving taste quality.

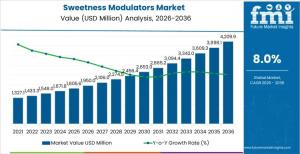

NEWARK, DE, UNITED STATES, January 16, 2026 /EINPresswire.com/ -- The global sweetness modulators market is projected to be valued at USD 1,950.0 million in 2026 and is forecast to reach USD 4,209.9 million by 2036, expanding at a compound annual growth rate (CAGR) of 8.0% over the forecast period. Growth is being driven by sustained reformulation activity across beverages, bakery, confectionery, and dairy products, where sugar reduction targets increasingly influence taste acceptance, regulatory compliance, and brand positioning.

Sweetness modulators are formulation ingredients that enhance perceived sweetness while enabling lower sucrose inclusion. Their adoption reflects how food and beverage manufacturers are responding to nutrition labeling rules, sugar taxation frameworks, and public health initiatives focused on reducing added sugar consumption. Beyond sweetness enhancement, these modulators play a functional role in bitterness suppression, flavor rounding, and temporal sweetness balance, particularly in reduced- and zero-sugar formulations.

Explore trends before investing – request a sample report today! https://www.futuremarketinsights.com/reports/sample/rep-gb-31441

Market Context: Sugar Reduction Without Taste Compromise

Demand for sweetness modulators is closely tied to the industry’s challenge of preserving taste while lowering caloric content. Beverage manufacturers rely on modulators to stabilize sweetness perception in zero-sugar carbonated drinks, flavored waters, and functional beverages, ensuring consistency across formats. In bakery and confectionery applications, modulators compensate for sweetness loss caused by sugar reduction, which can otherwise affect browning reactions, aroma release, and overall flavor intensity.

In dairy and ready-to-drink formats, sensory performance under varying pH, temperature, and processing conditions remains a critical evaluation criterion. Manufacturers also assess modulators for compatibility with stevia, monk fruit, and other high-intensity sweeteners to optimize cost, sweetness equivalence, and aftertaste control. As a result, sweetness modulators are increasingly viewed as long-term formulation tools rather than short-term reformulation fixes.

Clean Label Momentum and Regulatory Influence

Clean-label positioning is reshaping ingredient selection strategies across global markets. Consumer scrutiny of ingredient lists is accelerating adoption of plant-derived and fermentation-based sweetness modulators, particularly in products marketed for wellness and metabolic health. However, regulatory divergence across regions influences procurement decisions, as permitted usage levels and labeling definitions vary. This requires ingredient suppliers to maintain portfolio flexibility and regulatory coverage across multiple geographies.

Ongoing investment in sensory science, application laboratories, and scale-ready production supports wider adoption. Research teams conduct sensory trials to calibrate low-ppm usage levels that smooth harsh notes emerging after sucrose reduction, especially in complex matrices such as dairy desserts and baked goods.

Segmentation Highlights: Product Type, Application, and Form

By product type, natural sweetness modulators account for 48.0% of demand, reflecting strong alignment with clean-label strategies. Artificial modulators represent 32.0%, maintaining relevance in cost-sensitive formulations requiring batch-to-batch consistency. Blended modulators hold 20.0%, balancing taste performance, stability, and formulation flexibility.

By application, beverages dominate with a 34.0% share, driven by aggressive sugar reduction initiatives in carbonated drinks, juices, and functional beverages. Bakery and confectionery applications account for 22.0%, followed by dairy products at 16.0%, processed foods at 14.0%, pharmaceuticals at 9.0%, and other niche uses at 5.0%.

By form, liquid sweetness modulators lead with 46.0%, favored for precise dosing and uniform dispersion in beverage systems. Powder forms account for 38.0%, supporting bakery and dry mix applications, while granular formats represent 16.0%, serving specialized processing requirements.

Global Demand Patterns and Country-Level Growth

Global demand is rising as reformulation intensity increases rather than through volume expansion of finished food consumption. Growth is strongest in markets where regulatory pressure and public health objectives accelerate sugar reduction timelines.

• India: 9.6% CAGR, supported by growth in low-sugar beverages, nutraceuticals, and cost-optimized sweetener systems

• China: 9.3% CAGR, driven by large-scale reformulation in beverages, dairy, and functional nutrition

• Brazil: 8.8% CAGR, reflecting nutrition labeling compliance and reformulation of carbonated drinks

• United States: 7.8% CAGR, supported by added sugar disclosure requirements and large-scale reformulation programs

• United Kingdom: 7.6% CAGR, influenced by sugar levies, retail reformulation pressure, and clean-label preferences

Buy Report Now – Click Here to Purchase the Report: https://www.futuremarketinsights.com/checkout/31441

Competitive Landscape: Sensory Performance and Application Support

The competitive landscape is shaped by suppliers’ ability to deliver sensory reliability, regulatory acceptance, and scalable supply. Buyers prioritize sweetness enhancement efficiency, stability across processing conditions, and compatibility with high-intensity sweeteners.

Key players active in global demand include Cargill, Ingredion, Tate & Lyle, ADM, and DuPont (IFF). Competitive differentiation centers on formulation flexibility, application support, sensory validation capabilities, and consistent performance across beverage, dairy, bakery, and nutritional product matrices.

As sugar reduction strategies continue to reshape food and beverage portfolios worldwide, sweetness modulators are positioned as critical enablers of taste preservation, regulatory compliance, and long-term reformulation success.

Browse Related Insights

Sweetness Enhancers Market: https://www.futuremarketinsights.com/reports/sweetness-enhancers-market

Taste Modulators Market: https://www.futuremarketinsights.com/reports/taste-modulators-market

Flavor Modulators Market: https://www.futuremarketinsights.com/reports/flavour-modulators-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1,200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+18455795705 ext.

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.